omaha nebraska vehicle sales tax

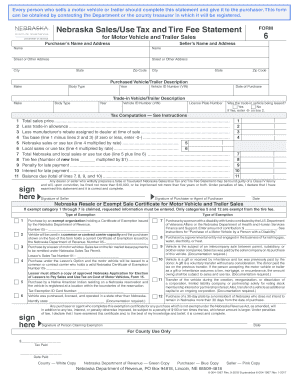

Form 6MB Nebraska Sales and Use Tax Statement for Motorboat Sales. Services are generally taxed at the location where the service is provided to the customer.

2021 Ne Dor Form 6 Fill Online Printable Fillable Blank Pdffiller

The current total local sales tax rate.

. James said he supports a repeal of the 10-cent-per-gallon gas increase approved in 2019 as well as a repeal of the states sales tax on. Omaha NE Sales Tax Rate. Once the MSRP of the vehicle is established a Base Tax set in Nebraska motor vehicle statutes is assigned to the specific MSRP range and motor vehicle tax is then assessed.

A definition of annexed is available in Nebraska Sales and Use Tax Regulation 1-01702A. Refer to Sales Tax Regulation 1-006 Retail Sale or Sale at Retail and Local Sales and Use Tax Regulation 9-007 Cities Change or Alteration of City Boundaries. At an estimated 8 million passenger vehicles in Pennsylvania the cost would be 2 billion but Shapiros campaign said some of those.

Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0824 on top of the state tax. This means that depending on your location within Nebraska the total tax you pay can be significantly higher than the 55 state sales tax. State Sales Tax 184718 Motor Vehicle Tax 700 Local Sales Tax 50378 Omaha Wheel Tax 50 Motor Vehicle Fee 30 Passenger.

The statistics are grouped by county. 100K for married couples filing. This is the total of state county and city sales tax rates.

Vehicles in Nebraska are registered in the county where the vehicle has situs which means in the county where the vehicle is housed majority of the time. The MSRP on a vehicle is set by the manufacturer and can never be changed. Greater Omaha Chamber of Commerce UNO.

Nebraska vehicle title and registration resources. Department of Revenue Current Local Sales and Use Tax Rates Vehicles Towed from Private PropertyVehicles Left Unattended on Private Property. A vehicle that is recorded on the Purchasers Agreement which in turn is used to complete the Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6 as a trade-in must be titled in the name of the purchaser.

Campos Tax Services Edinburg Tx. A 5 percent sales tax is imposed by Nebraska on all sales and use. Nebraska has a 55 statewide sales tax rate but also has 295.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective July 1 2022 Updated 03032022 There are no changes to local sales and use tax rates that are effective July 1 2022. Motor vehicle sales tax collection information is compiled from monthly county treasurers reports. The percentage of the Base Tax applied is reduced as the vehicle ages.

The Nebraska state sales and use tax rate is 55 055. All security system wires and equipment parts that are installed and remain tangible personal property after installation are retail sales and the total amount charged for such items and installation is subject to sales tax. The Omaha sales tax rate is.

Vehicle Title Registration. Nebraska lawmakers want to slash income tax for some expand sales taxes. Stay up-to-date on the latest in local and national government and political topics with our newsletter.

The County sales tax rate is. LB 1264 would eliminate all state income taxes on the first 50000 for an individual. NE Sales Tax Rate.

2021 December 2021 and December 2020 03032022 November 2021 and November 2020 02032022 October 2021 and October 2020 01042022 September 2021 and September 2020 12022021 August 2021 and August. FILE - Mississippi Lt. You can find more tax rates and.

In September 2021 the court heard oral. Delbert Hosemann speaks to reporters regarding the purposed Tax. Because they challenged the constitutionality of the states laws that allow for tax lien sales the Nebraska Supreme Court added the case to its docket.

Sweet Life Quotes Images. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective April 1. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less.

Omaha Ne Sales Tax Calculator. The Nebraska sales tax rate is currently. Inspired Living Omaha spotlights home design fashion food entertaining design travel more.

Speak Victory Over Your Life Scripture. Newly purchased vehicles must be registered and sales tax paid within 30 days of the date of purchase. Kia Motors is planning for more than half.

How Much Do Car Plates Cost In Nebraska. Or Form 6XMB Amended Nebraska Sales and Use Tax Statement for Motorboat Sales. Each new duplicate or replacement plate reclassified to the Highway Trust Fund will incur a fee of 30.

The minimum combined 2022 sales tax rate for Omaha Nebraska is. This example vehicle is a passenger truck registered in Omaha purchased for 33585. Deliveries into another state are not subject to Nebraska sales tax.

A fillable Form 6 Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales is now available on DORs website.

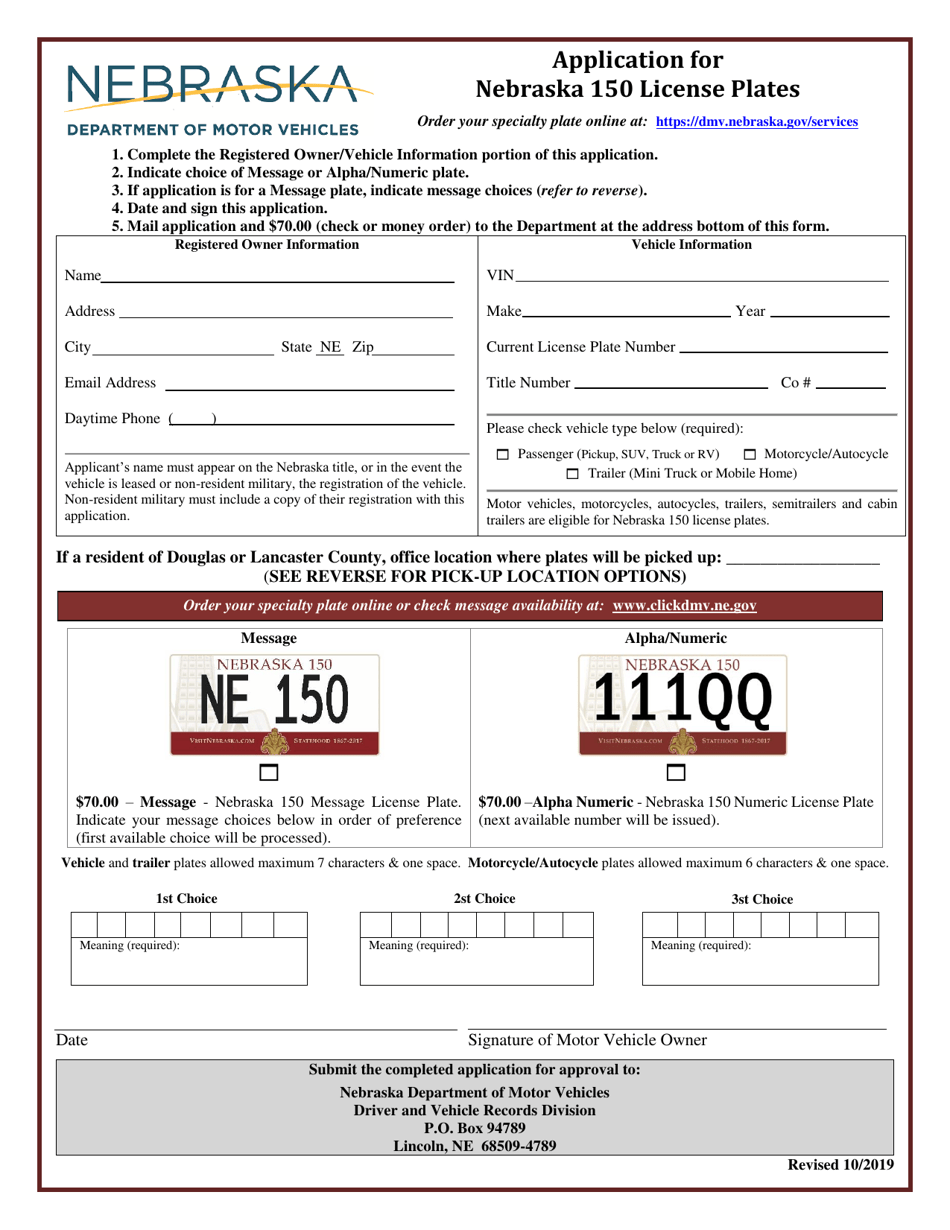

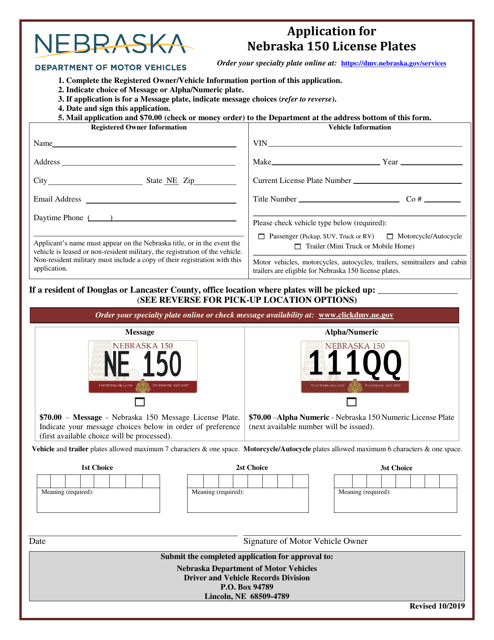

Nebraska Application For Nebraska 150 License Plates Download Printable Pdf Templateroller

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

Nebraska Application For Nebraska 150 License Plates Download Printable Pdf Templateroller

Sales Tax On Cars And Vehicles In Nebraska

Lawn Care Truck Wrap Dallas Zilla Wraps Lawn Care Lawn Service Lawn Care Business

All About Bills Of Sale In Nebraska The Forms And Facts You Need

2021 Ne Dor Form 6 Fill Online Printable Fillable Blank Pdffiller

Nebraska Swd Green2stay Phone 402 465 5756 Fax 209 774 4027 Email Info Restoreamusclecar Com Hours Mon Fri 8a Restoration Muscle Automotive Industry

Latest Information On Dmv Services Nebraska Department Of Motor Vehicles

Superlative 1927 Sinclair Aviation Gasoline Restored American Visible Gas Pump Model 2487 Barrett Jackson Auction Company Gas Pumps Vintage Gas Pumps Gas

How To Get A Resale Certificate In Nebraska Startingyourbusiness Com

Free Nebraska Purchase Agreement Form Pdf 2883kb 17 Page S Page 2 Purchase Agreement Agreement Legal Forms

2021 Ne Dor Form 6 Fill Online Printable Fillable Blank Pdffiller

Contact Us Nebraska Department Of Revenue

Map Of Peony Park Vintage Beach Posters Omaha Nebraska Vintage Beach

Pros And Cons Of An Open House In Omaha Nebraska Sell My House Fast Sell My House Open House